After we were able to paint a fairly positive picture last year, this trend has unfortunately not continued. This conclusion can be drawn from the responses of decision-makers from various industry players in the major BAR NEWS partner survey. Only 40% of respondents were satisfied with the year 2023, while almost 60% were dissatisfied as far as the food service industry was concerned. In wholesale, 50 percent were satisfied, but almost 50 percent were dissatisfied. In retail, on the other hand, only 50 percent of respondents were satisfied, while the other half were dissatisfied.

For this year, 45% of respondents expect business to improve, while the remainder expect business to remain roughly the same this year. Only a limited positive trend was observed in the assessment of the Christmas and end-of-year business, which is particularly important for the spirits industry. Compared to the same period in the previous year, just under 60% reported a roughly similar business performance, while the remainder reported a worse result than in the previous year.

Good mood in the gastronomy sector

The gastronomy sector remains positive in its assessment of the beverage industry. The majority of respondents were also satisfied with the wholesale sector (pick-up market). After the positive results in previous years, respondents were less satisfied with the results achieved in the retail trade. This is hardly surprising when you consider how the retail trade has benefited greatly during the coronavirus pandemic, particularly in the beverage sector. Respondents see the outlook for this year as follows: Gastronomy 65 percent good to very good, retail 55 percent good to very good, 45 percent less good, in wholesale 90 percent good. The majority of end consumers (75%) are in a good mood. The assessment of opportunities shows that consumer sentiment is particularly positive. People are going out again and enjoying themselves more consciously. The increased demand for domestic products is seen as a positive factor, particularly by Swiss suppliers.

In the risk assessment, it is noticeable that price increases and margin pressure are still causing problems. There are also still supply bottlenecks in certain areas. However, the global political situation, particularly in Europe, combined with a less optimistic mood will also have an impact. Developments are even more difficult to predict than before. Sales in the retail sector will continue to decline as a result of the continuing good level of spending. Purchasing power in the medium and higher-priced luxury segment, which was extremely high in the coronavirus era, will continue to decline and end consumers will opt for cheaper products. According to respondents, the legal framework and advertising regulations in Switzerland remain difficult. Around the same as last year, 60% of the companies surveyed were also confronted with parallel or gray imports in many spirits categories.

Behavioral optimism

A cautiously optimistic mood is evident when it comes to the expected changes in turnover for the coming year. Around 50 percent of those surveyed expect sales growth of up to 5 percent, while 10 percent of those surveyed even expect an increase in sales of up to 10 percent. 30 percent of respondents expect sales to stagnate this year. Some companies anticipate good results this year due to planned product launches and segment expansions in the portfolio. Internal company adjustments should also lead to improved results.

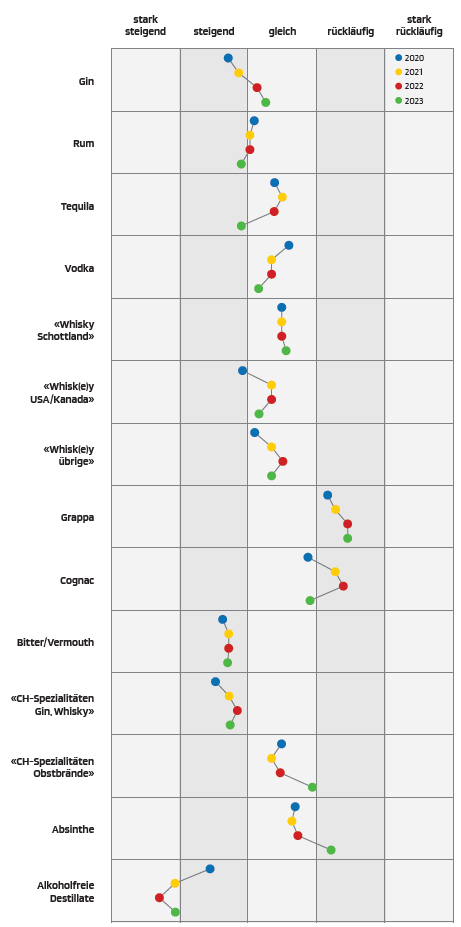

Market assessment by spirits categories

Respondents continue to forecast a positive trend in the non-alcoholic distillates categories. The categories of rum, tequila, vodka, whiskey from the USA and, as before, the Swiss products gin and whisky are also expected to grow. In general, the gin sector is still rated positively, but not as strongly as in recent years. Growth, albeit somewhat slower, is expected in the gin, rum and whisky segment. Cognac is expected to increase again this year for the first time. The Swiss fruit brandy and absinthe categories have seen a downward trend.